Exness, founded in 2008, is a globally trusted broker offering trading in forex, crypto, stocks, indices, metals, and energies. Regulated by leading authorities such as CySEC, FCA, FSCA, and CMA, it provides fast execution, tight spreads, deposits from just $1, stop-out protection, customizable leverage, and no overnight fees on major instruments.

| Key Features | Details |

|---|---|

| Founded | 2008 |

| Regulators | CySEC, FCA, FSCA (South Africa), CMA (Kenya), FSA (Seychelles), CBCS, FSC (BVI, Mauritius) |

| Minimum Deposit | As low as $1 (varies by account type) |

| Trading Instruments | Forex, Crypto, Metals, Energies, Indices, Stocks |

| Platforms | MetaTrader 4, MetaTrader 5, Exness Mobile App |

| Execution Speed | Execution within milliseconds on all platforms |

| Spreads | Consistently tight spreads, stable even during high volatility |

| Stop Out Protection | Specialized stop-out protection to reduce premature stop-outs by approximately 30% |

| Overnight Fees | No overnight fees for FX majors, most FX minors, crypto, gold, and indices |

| Leverage | Customizable up to unlimited leverage |

| Client Support | 24/7 multilingual support in English, Chinese, Arabic, Thai, Vietnamese, Hindi, Bengali, Urdu |

| Global Offices | Cyprus, UK, Seychelles, South Africa, Curaçao, BVI, Kenya |

| Trading Tools | 30+ technical indicators, 23 analytical tools, expert advisors, automated trading, trailing stops |

| Security | Advanced 128-bit encryption on MT4 and MT5 platforms |

| Automated Trading | Full support for robots, Expert Advisors (EAs), and custom scripts via MQL4 |

| Withdrawal Speed | Instant withdrawals available even on weekends |

| Compensation Fund | Membership in Financial Commission offering up to €20,000 per client coverage |

Exness Regulation and Licensing

Exness operates under strict oversight by prominent financial authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA), ensuring a secure and transparent trading environment. These regulations help protect traders by promoting fairness and safety.

In addition, Exness holds licenses from other reputable regulators, such as the Financial Services Authority (FSA) of Seychelles, the Central Bank of Curaçao and Sint Maarten (CBCS), the Financial Services Commission (FSC) of Mauritius and the British Virgin Islands, South Africa’s Financial Sector Conduct Authority (FSCA), and Kenya’s Capital Markets Authority (CMA).

Why Traders Prefer Exness

Traders favor Exness due to several key advantages:

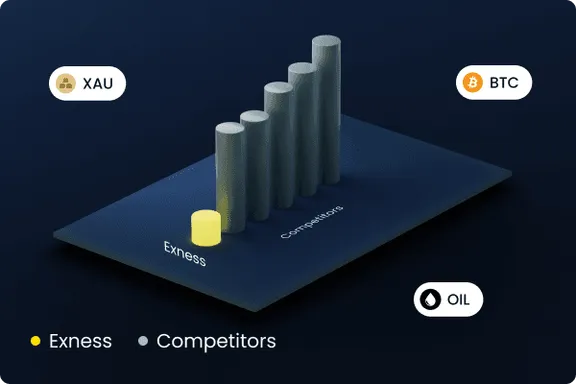

- Attractive Spreads and Low Fees: Exness provides tight spreads, helping traders minimize trading costs.

- Flexible Leverage: Traders benefit from high leverage options, potentially increasing profits.

- Immediate Withdrawals: Fast and seamless withdrawal processing enhances convenience.

- Variety of Accounts: Multiple account types meet the needs of diverse traders.

- Reliable Support: 24/7 multilingual customer support ensures prompt assistance.

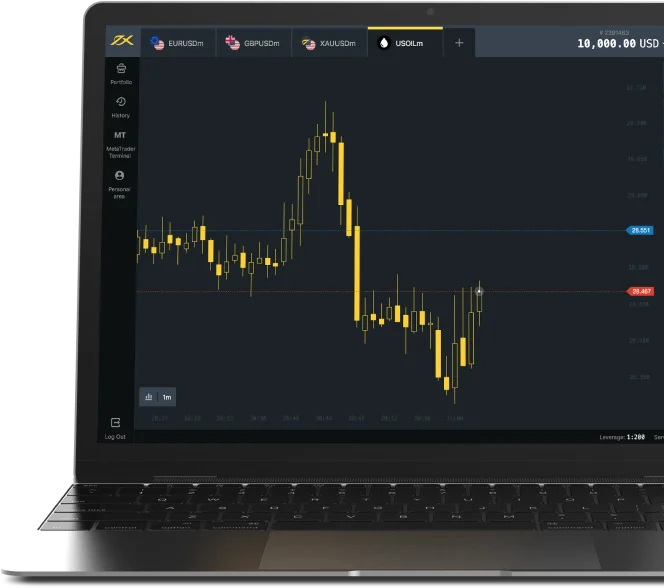

Exness Trading Platforms

Exness provides multiple trading platforms tailored to various trader preferences. MetaTrader 4 (MT4) is widely preferred for forex and CFD trading, featuring advanced analytics, customizable charts, and support for automated strategies. MetaTrader 5 (MT5), an upgraded version of MT4, offers additional tools, including more indicators, timeframes, and an integrated economic calendar.

Exness Mobile App enables traders to easily manage their trades from both Android and iOS devices, while the Exness Web Platform allows quick trading access directly from any browser, without the need for software installation.

Exness MetaTrader 5 Platform

Exness MT5 builds upon MT4’s strengths, delivering advanced features tailored for active traders. Apart from forex, MT5 allows trading in stocks, indices, and metals. Key enhancements include:

- Expanded Technical Tools: Access over 38 built-in indicators, 21 different timeframes, and numerous graphical analysis objects.

- Built-in Economic Calendar: Keep track of global financial events and economic data directly within the platform, aiding informed trading decisions.

- Advanced Order Management: Utilize four execution methods and six pending order types, providing precise control over trade entries and exits.

- Upgraded Strategy Tester: Efficiently backtest Expert Advisors (EAs) using historical market data, with improved speed and accuracy.

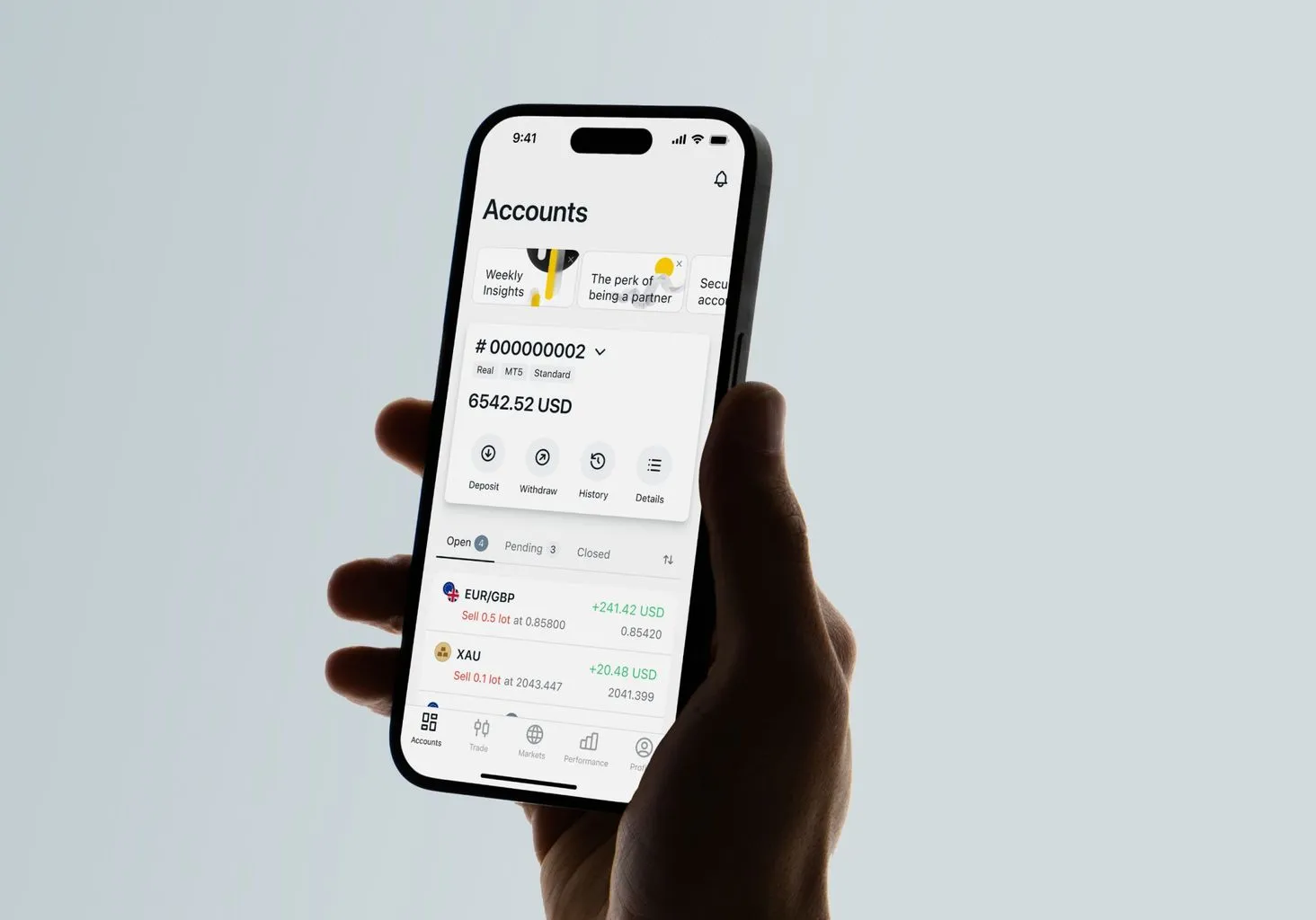

Exness Mobile Apps

Exness mobile apps offer the complete trading experience on both iOS and Android devices, enabling traders to execute and manage their trades conveniently from anywhere. They fully replicate the functionality of the desktop platform, featuring:

- Comprehensive Trading: Execute orders, monitor account status, and manage your positions seamlessly.

- Intuitive Mobile Interface: Designed specifically for smartphones and tablets, ensuring smooth navigation and ease of use.

- Real-Time Market Information: Access live quotes and charts for accurate, timely trading and analysis on the move.

Web Terminal

Traders consistently select Exness due to superior trading conditions, innovative features, advanced security measures, transparency, and outstanding customer support.

- Instant Withdrawals

Maintain full control over your funds. Simply select your preferred payment method, submit a withdrawal request, and benefit from immediate automated processing.¹ - Ultra-Fast Execution

Seize market opportunities with rapid order execution. Trades at Exness are processed within milliseconds across all platforms. - Stop Out Protection

Take advantage of our exclusive Stop Out Protection, designed to help you delay or even completely prevent stop outs during volatile trading conditions.

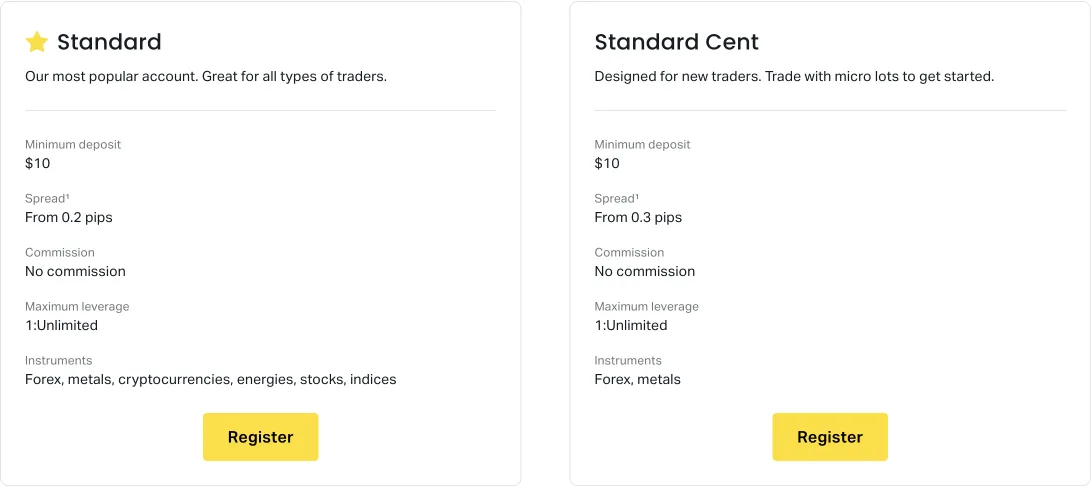

Exness Trading Accounts

Exness provides multiple trading account options tailored to various trader profiles. The Standard Account is ideal for new traders, featuring no trading commissions and a low initial deposit requirement. Professional Accounts cater to seasoned traders seeking advanced functionality, tighter spreads, and specialized conditions, though typically requiring a higher deposit. Additionally, Exness offers a Demo Account, allowing users to practice trading strategies risk-free using virtual funds.

Exness Standard Account

Exness Account is designed for traders of all experience levels who prefer straightforward trading conditions. It is recognized for simplicity and accessibility. Key highlights include:

- Minimum Deposit: Minimal or no initial deposit required, ensuring accessibility for every trader.

- Spreads: Attractive spreads from 0.3 pips, varying with market conditions and trading instruments.

- Leverage: Customizable leverage up to 1:2000, enabling traders to manage their risk effectively.

- Commission: No trading commissions; costs are integrated directly into spreads.

- Execution: Instant order execution without re-quotes, ensuring efficient trading.

- Flexibility: Compatible with diverse trading styles, including scalping and hedging strategies.

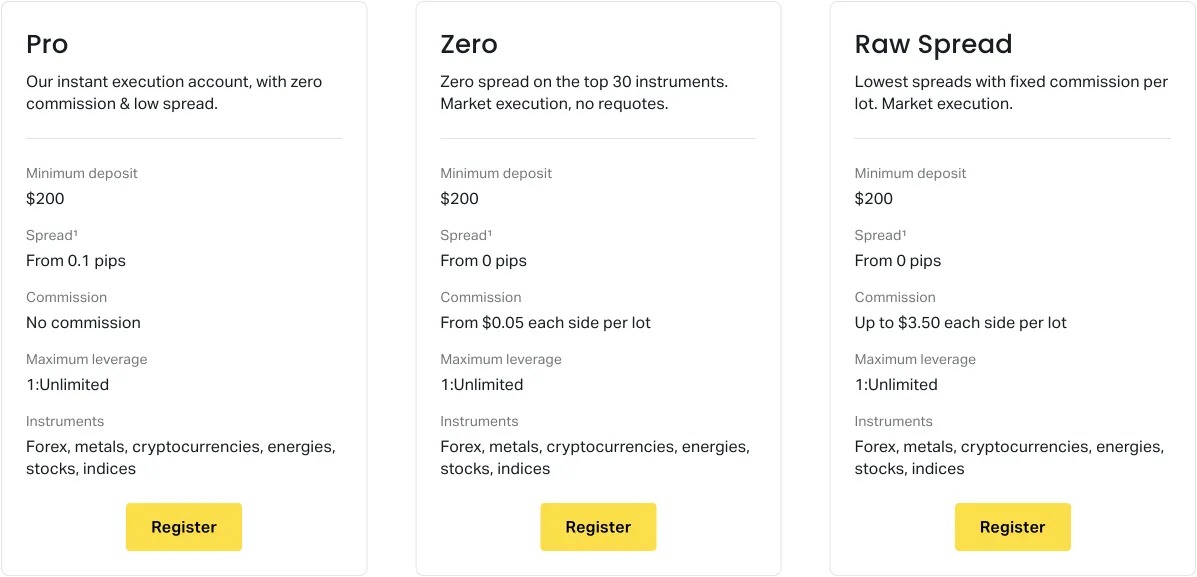

Exness Professional Accounts

Exness Professional Accounts are specifically designed for skilled traders who seek advanced trading features and enhanced conditions. Traders can choose from several professional account types, such as:

- Raw Spread Account: Delivers ultra-tight spreads starting at 0.0 pips and charges a low commission per trade, perfect for high-volume traders using complex strategies.

- Zero Account: Offers zero spreads on major currency pairs with a fixed commission, making it ideal for scalpers and frequent traders.

- Pro Account: Combines features of Raw Spread and Zero accounts, providing competitive spreads without extra commission fees, suited for experienced traders seeking balanced trading conditions and cost-efficiency.

Exness Demo Account

The Exness Demo Account provides a risk-free environment where new traders can learn trading fundamentals, and experienced traders can safely test strategies without financial exposure. Key features include:

- Virtual Funds: Traders receive virtual money to freely test strategies and familiarize themselves with platform functions without risk.

- Realistic Market Conditions: Accurately simulates live market conditions, ensuring traders gain practical experience for real-world trading scenarios.

- Easy Accessibility: Compatible with MetaTrader 4 and MetaTrader 5, including web and mobile platforms.

- Unlimited Duration: Typically has no expiration, allowing traders ample time to refine and thoroughly test trading strategies.

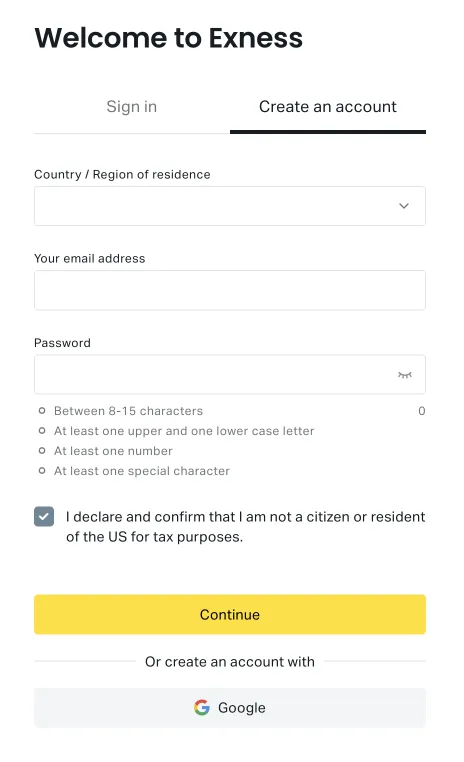

Exness Sign-Up

How to Register an Exness Account

Creating an Exness account is quick and straightforward. Follow these simple steps to get started:

- Visit Exness Official Website: Go to the Exness homepage.

- Click “Register”: Locate and click the “Register” button, typically found in the top-right corner of the website.

- Fill in the Sign-Up Form: Provide your email address, create a password, and specify your country of residence and preferred trading platform.

- Email Verification: Click the verification link sent to your email to confirm your address.

- Complete Your Profile: Enter your personal details, including your full name, date of birth, and contact information.

- Agree to Terms: Review and accept Exness’s terms and conditions to complete the registration.

Alternatively, you can sign up quickly using your Google account for even faster registration.

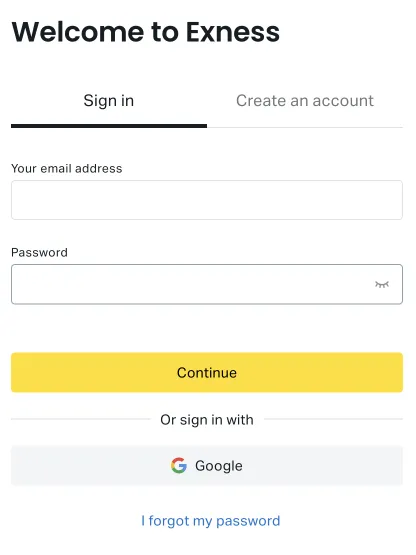

Exness Login

After completing registration, accessing your Exness account is straightforward. Simply follow these steps:

- Visit the Login Page: Go to the Exness website and select the “Login” button.

- Enter Login Details: Provide your registered email address and password.

- Complete Security Check: You may be prompted to complete a CAPTCHA or two-factor authentication (2FA) based on your security preferences.

- Manage Your Account: After successful verification, you’ll arrive at your Exness dashboard to manage trades, deposits, withdrawals, and settings.

Exness Account Verification

For the security of your transactions and compliance with financial regulations, Exness requires you to verify your account. This process not only helps protect your trades and personal data but also deters fraud and money laundering.

Step-by-Step Verification

Proof of Identity (POI):

Upload a clear copy of a government-issued photo ID—such as a passport or national ID. Ensure the document displays your full name and a recognizable photo.

Proof of Residence (POR):

Provide a recent utility bill, bank statement, or official document showing your full name and current address. The document must be dated within the last three months.

By completing the verification process, Exness can maintain a more secure trading environment and safeguard your financial assets.

Required Documents for Verification

- Government-Issued Photo ID: Passport, national ID card, or driver’s license.

- Recent Utility Bill or Bank Statement: Must reflect your full name and address, dated within three months.

- Additional Documents: Depending on local regulations, you may need to provide extra documents, such as tax statements or proof of insurance.

Exness Trading Instruments

Exness offers a broad selection of instruments across multiple asset classes, ensuring diverse opportunities for traders with different strategies and investment preferences. Below is an overview of what’s available:

Metals

Exness allows traders to invest in precious metals, commonly seen as secure assets during market uncertainties:

- Gold and Silver: Often paired with major currencies, these metals serve as popular tools for hedging against inflation and currency fluctuations.

- Other Metals: Includes options like platinum and palladium, broadening the commodity trading landscape for those seeking alternative opportunities.

Energy Commodities

These essential resources significantly influence the global economy and offer extensive trading possibilities:

- Oil: Encompasses benchmarks such as Brent Crude and WTI (West Texas Intermediate), both pivotal in gauging overall economic sentiment.

- Natural Gas: Another leading energy resource, driven by factors ranging from regional and political issues to environmental considerations.

Stocks & Indices

Exness facilitates trading in both global equities and major market benchmarks:

- Stocks: Access individual shares from prominent international corporations, allowing direct investment in specific businesses.

- Indices: Trade popular indices like the S&P 500, NASDAQ, and Nikkei 225, which track overall market performance and key economic trends.

Cryptocurrencies

As digital currencies gain increasing traction, Exness provides an array of crypto trading options:

- Major Cryptocurrencies: Includes Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), offering access to leading digital markets.

- Altcoins: Features smaller, more volatile assets with the potential for substantial returns.

Exness Spreads and Commissions

Exness offers competitive pricing that depends on both the account type and the instruments being traded. Understanding the spread structures, trading fees, and any related charges is vital for effectively managing overall costs.

Spread Options at Exness

Exness caters to diverse trading strategies with various spread formats:

- Variable Spreads: These adjust in response to market conditions, typically tighter when liquidity is high and wider when liquidity is low. Standard Accounts commonly feature variable spreads on major forex pairs.

- Fixed Spreads: Offered on select instruments, fixed spreads remain constant irrespective of market volatility, providing more predictable costs. However, they’re usually wider than the lowest variable spreads to offset risk during high volatility.

- Raw Spreads: Available within Raw Spread Accounts, these represent Exness’s tightest spreads, starting from 0.0 pips. Traders in these account types generally pay a commission per trade.

Other Fees

Beyond spreads and commissions, traders should consider additional costs that may impact their trading expenses:

- Overnight Fees (Swap Fees): Applied to positions held overnight, with the amount depending on the specific instrument and whether the trade is long or short.

- Inactivity Fees: Certain accounts may be charged if no trading activity occurs over a prolonged period. Check the terms associated with your account type.

- Deposit and Withdrawal Fees: Exness generally does not impose charges for deposits or withdrawals; however, payment service providers or banks may apply their own fees, which lie outside Exness’s control.

Exness Analytical Tools

Exness equips traders with a suite of resources designed to enhance their strategies and support well-informed decisions. These offerings cover economic event monitoring and in-depth technical analysis, both of which are crucial for developing strong trading methodologies.

Economic Calendar

The Economic Calendar is an invaluable resource for traders, particularly in the forex market, as it highlights key upcoming economic announcements and their potential impact on the financial sector. Key features include:

- Forecast and Historical Data: View anticipated outcomes and past market reactions to similar events to inform trading strategies.

- Real-Time Updates: Stay prepared for sudden market shifts as the calendar refreshes automatically once new data is released.

- Customizable Alerts: Set notifications for specific events, ensuring you never miss crucial market-moving information.

Technical Analysis

Exness supports technical analysis with cutting-edge charting solutions and a wide range of indicators, enabling traders to study price patterns and spot emerging market trends. Key highlights include:

- Advanced Charting: Access multiple chart styles, timeframes, and drawing tools for in-depth price action evaluation.

- Indicators and Oscillators: Utilize an extensive library of technical indicators—such as Moving Averages, RSI, MACD, and Bollinger Bands—to identify market trends and potential reversals.

- Automated Analysis Tools: Leverage automated features that detect patterns and trading signals, simplifying strategy execution based on technical data.

Trading Signals

Trading signals are recommendations generated by advanced algorithms or expert trader insights, and Exness offers access to a variety of these tools. Common features include:

- Entry and Exit Points: Signals frequently suggest optimal times to open or close a position, grounded in in-depth market analysis.

- Risk Management Parameters: Suggestions often include stop-loss and take-profit levels, helping traders effectively limit and manage risk.

- Diverse Strategies: Signals span different trading methods, making them adaptable for a wide range of trading styles and preferences.

Financial News

Keeping current with financial news is essential for traders, as market sentiment and prices can shift dramatically based on the latest developments. Exness provides:

- Real-Time News Feeds: Embedded directly within the trading platforms for instant access to global financial updates.

- Expert Market Analysis: Professional insights and commentary help clarify how news events may influence market behavior.

- Customizable Alerts: Set notifications for news related to specific markets or instruments, ensuring traders stay informed on their areas of interest.

Exness Profit Calculator

Exness Profit Calculator is a powerful tool that allows traders to gauge potential profits or losses in advance, promoting more informed risk management and trading decisions. Key features include:

- Flexible Input Parameters: Customize settings such as instrument, lot size, leverage, and entry/exit prices to reflect your exact trading plan.

- Risk Assessment: Evaluate potential downside by identifying optimal stop-loss and take-profit targets based on calculated figures.

- Instant Calculations: Obtain immediate profit or loss estimates, enabling quick strategic adjustments and enhanced decision-making.

Exness Trading Conditions

Exness delivers trader-friendly conditions characterized by:

- Tight Spreads: Competitive spreads, starting as low as 0.0 pips on Raw Spread accounts.

- High Leverage: Leverage options up to 1:2000, allowing traders to amplify market exposure with less initial capital.

- Market Execution: Ensures swift, reliable order fulfillment without re-quotes for a smoother trading experience.

Minimum Deposits

Exness sets its minimum deposit requirements according to the account type:

- Standard Accounts: Often require very low deposits—sometimes as little as $1—making them accessible for traders of every experience level.

- Professional Accounts: Demand higher initial deposits, which come with advanced features and tighter spreads.

Leverage

Exness provides some of the most adaptable leverage options in the industry, designed to suit varying trading styles and risk profiles:

- Flexible Choices: Depending on the instrument and a trader’s equity, leverage can range from 1:2 up to 1:2000.

- Dynamic Leverage: The system automatically modifies leverage based on open positions, helping traders manage risk more effectively.

Order Execution Speed

Takes pride in its extremely fast order execution—a vital aspect for traders who rely on swift entries and exits:

- High-Speed Execution: Orders typically go through in milliseconds, minimizing slippage and allowing traders to open and close positions at desired price levels.

- Reliability: With a continuously optimized trading infrastructure, Exness maintains consistent and dependable execution, even during periods of high market volatility.

Exness Deposits & Withdrawals

Exness streamlines account funding with diverse deposit and withdrawal methods, prioritizing quick processing and minimal fees to create a better user experience. Here’s an overview:

Deposit Methods

To cater to different preferences and regions, Exness provides a wide range of deposit options:

- Credit/Debit Cards: Visa, MasterCard, and other major card providers, offering near-instant funding.

- E-Wallets: Services like Skrill, Neteller, and WebMoney for secure and rapid transactions.

- Bank Wire Transfers: Ideal for larger sums, although they may take a few business days to process.

- Local Payments: Region-specific payment methods tailored to meet local customer needs.

Withdrawal Methods

Exness generally aligns its withdrawal options with the original deposit methods, ensuring a straightforward process:

- Credit/Debit Cards: Typically processed within a few hours, although it can extend to several business days depending on the card issuer.

- E-Wallets: Generally instant once the request is initiated, allowing fast access to funds.

- Bank Wire Transfers: May require several business days, subject to banking systems and regional differences.

Transaction Speed

Exness has a reputation for quick deposit and withdrawal processing:

- Deposits: Typically completed almost instantly with most payment options; however, bank wire transfers may experience delays due to varying bank procedures.

- Withdrawals: Most withdrawal methods are processed immediately, so funds appear in e-wallets within minutes, while bank transfers and credit card withdrawals may take a few hours to several days, depending on the financial institution.

Tips for New Exness Traders

Embarking on your trading journey with Exness is both thrilling and demanding. To boost your chances of success, consider these foundational tips:

- Educate Yourself:

Explore Exness’s educational materials—webinars, tutorials, and articles—to build a solid understanding of Forex fundamentals and trading platforms. - Start with a Demo:

Practice on a demo account before transitioning to live trading. This approach helps you get comfortable with market fluctuations and platform tools without risking real funds. - Create a Trading Plan:

Clearly define your objectives, risk tolerance, and preferred strategies. A structured plan promotes disciplined decision-making and reduces impulsive actions. - Use Risk Management Tools:

Utilize features like stop-loss orders to protect your capital. Effective risk control is crucial, especially in volatile markets. - Stay Informed:

Keep track of key financial updates and market events using Exness’s economic calendar. Being current on news can significantly influence your trading decisions. - Regularly Evaluate Performance:

Periodically assess your trades to ensure your strategies align with evolving market conditions and personal financial objectives. Adjust tactics as needed based on results. - Practice Patience and Consistency:

Recognize that trading prowess develops over time. Stay committed to your strategies, learn from both gains and losses, and strive for continuous improvement.

FAQ

Is exness legal in india?

Exness does not hold a license from SEBI (India’s securities regulator); however, it is regulated by various international bodies, such as CySEC and the FCA. There is no official ban preventing Indians from trading with Exness, but you should always comply with local financial and tax regulations.